About

Maharashtra's Tourism Policy

The Maharashtra Tourism Policy outlines the state’s strategy for Maharashtra state tourism. It was released in the year 2016. It is under the Directorate of Maharashtra Tourism Department. It focuses on tourism as a priority sector. It has the potential to generate employment and economic development in Maharashtra.

Maharashtra is the third largest State of India, both in area & population. Nestled in the Western Ghats & the Sahyadri mountain range are several hill stations and water reservoirs with semi-evergreen and deciduous forests. The Vidarbha region of Maharashtra, with its dense forests, is home to several wild life sanctuaries and nature parks. Thus all the three regions of Maharashtra offer considerable tourism potential.

Currently, Maharashtra Tourism contributes around 9% of the total Maharashtra GDP. The policy aims to create a conducive environment for investments and infrastructure.

Create a three-tier institutional Government mechanism – Create a committee under the chairmanship of the Principal Secretary of Tourism which Focuses on implementation of Maharashtra Tourism Policy. The tourism minister of Maharashtra will supervise its functions. Supervise single window clearance for the Hospitality industry.

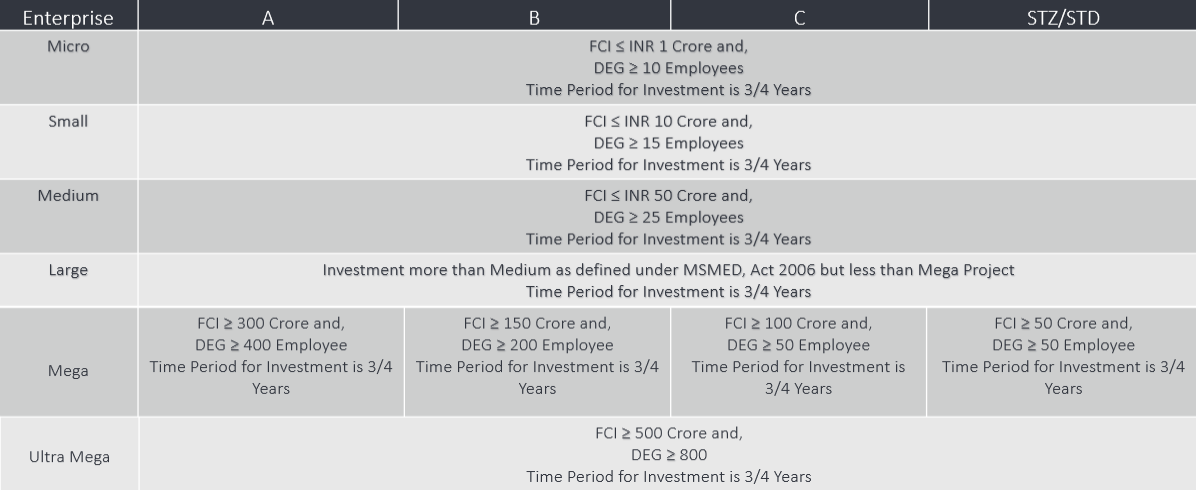

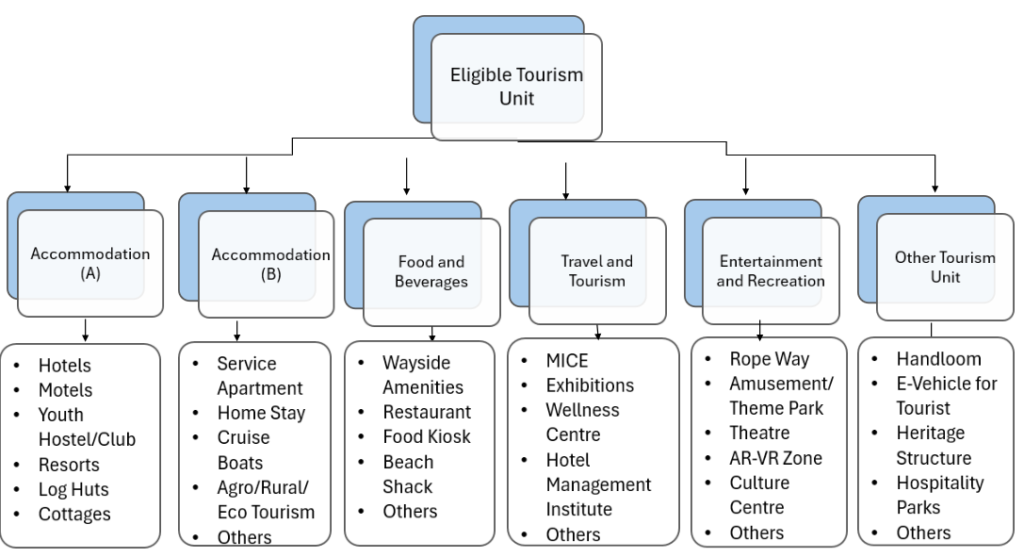

ELIGIBLE UNITS

Existing, New, Expansion of Existing

Establishment covered for subsidy

Permissible benefits / incentiveS

-

Upto 20% capital subsidy

By taking advantage of the subsidy available for eligible capital investments, which covers up to 20% of the total cost, significant cost savings can be achieved, thereby enhancing the overall financial efficiency and profitability of the project.

-

Tax Holiday under Income Tax

Claiming a tax holiday benefit of 5 to 10 years under income tax provisions provides temporary relief from tax liabilities, encouraging investment and growth.

-

Upto 100 % Reimbursement of Net SGST

Benefit from significant cost savings with our assistance in securing up to 100% reimbursement of Net SGST paid on sales, maximizing your financial returns.

-

Upto 100% Electricity Duty Exemption

Ensure substantial reductions in operational costs with our support in obtaining up to 100% exemption from electricity duty, allowing you to allocate resources more efficiently.

-

Upto 100 % Stamp Duty Exemption

Simplify property acquisition processes and minimize financial burdens by accessing up to 100% exemption on stamp duty, ensuring seamless expansion or establishment of your hospitality venture.

-

Procurement of Additional FSI at Discounted rate

Enhance your construction potential and optimize land usage with our expertise in procuring additional Floor Space Index (FSI) at discounted rates, facilitating the development of your project with cost-effective solutions.

-

Other Incidental Benefits

Unlock a myriad of incidental benefits tailored to your specific project needs, including but not limited to subsidies on development charges, water charges, and property taxes, allowing you to maximize returns and streamline operations.